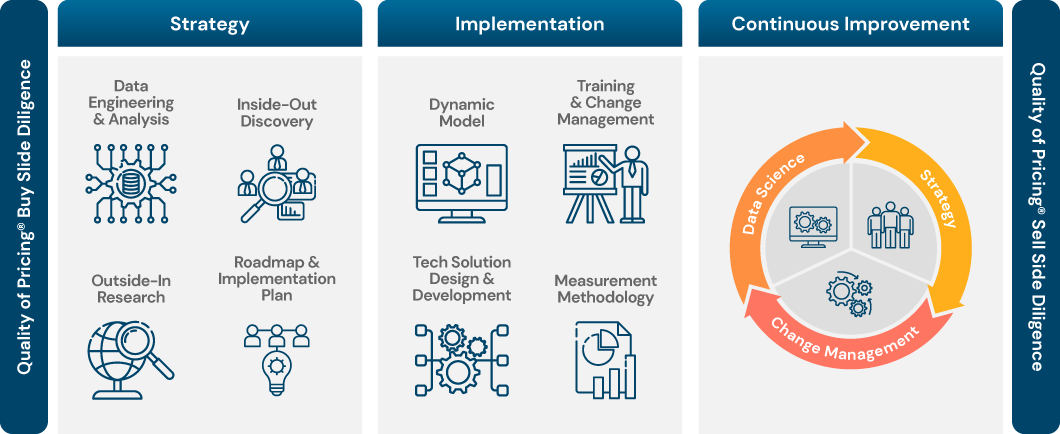

Pricing Strategy | Build a quality, data-driven pricing strategy that delivers real results

Our pricing experts learn your business inside-out, leverage external market intelligence and competitive factors, and develop a tailored strategy and implementation plan backed by quantitative and qualitative analysis – that brings real results to your bottom line.

Change Management | INSIGHT is relentless in making sure your strategy and goals come to life

Profit opportunities don’t exist in a vacuum. Clients need solutions that are deployed effectively to maximize the realization and impact. We are relentless in making your strategy come to life and partner with you to deliver training and process adoption with transparent methodology and communication.

Data Science & Technology | INSIGHT combines expert data engineers, developers, and data scientists to deliver scalable end-to-end solutions

We embrace messy, unstructured data and turn it into actionable knowledge – and we do it quickly. Then, we partner with our clients to develop dynamic AI/ML models and technology solutions tailored to your business and built alongside your input, enabling proactive, data-driven decision-making.

Continuous Improvement | Ongoing pricing excellence advancement to achieve continued profit impact for the long-term

INSIGHT is your partner to deliver complete solutions that drive ongoing incremental EBITDA growth. After deploying tailored technology solutions that systematize your business processes, we continuously advance your model to optimize your pricing and adapt to business and market changes. Then, we build organizational competencies to ensure pricing remains a profit center ongoing. Last, we measure everything we do so Clients can continuously improve.

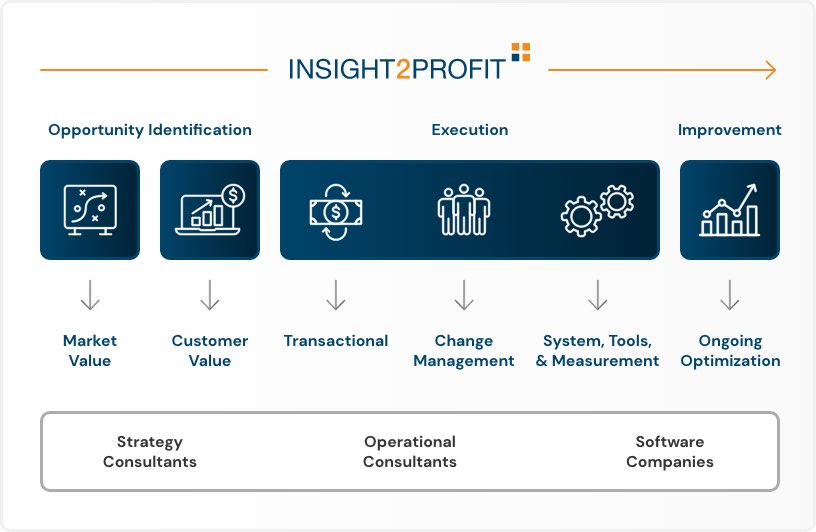

Only INSIGHT has the End-to-End Expertise…One Trusted, Comprehensive Partner