Industrial Equipment Distributor

Scaling Success: A Data-Driven Approach to Pricing and Profitability

Profit Unlocked: $40M in Growth with Centralized Pricing Solutions

Transforming a decentralized, highly competitive business into a pricing powerhouse through data-driven strategies and scalable tools.

This equipment distributor was challenged with aligning pricing across the organization in an environment of fragmented and regional processes. Despite rapid growth, inconsistent margins, limited pricing tools, and regional competitiveness hindered profitability. By implementing a centralized and tailored pricing strategy, leveraging advanced analytics, and deploying scalable quoting solutions, the company achieved $40M in EBITDA growth across multiple years. This case study explores how a focused, multi-step approach to pricing optimization turned complexity into opportunity, laying the groundwork for sustained financial success.

Explore More Case Studies

Situation

Disconnected Systems, Disconnected Strategy: The Case for Change

- Highly decentralized business with many different locations, processes, and product types experiencing growth through acquisitions

- Operating in a highly competitive, regional industry with limited understanding of willingness to pay and not leveraging price as a strategic lever

- Out of date list prices that were not market relevant

- Despite margin growth, many areas of the business were not maintaining margin %

- Limited data sophistication, segmentation, and measurement tools & processes, which led to inability to set or realize goals based on potential opportunity

- Limited organizational pricing culture

Findings: Buy Side Quality of Pricing

Conducted buy-side assessment that identified significant margin opportunity

Limited Differentiation

- Products or services are lacking clear value distinction

- This can lead to pricing pressure, margin erosion, and lost opportunities for growth

Price and Cost Change

- Cost change is outpacing price change realization in parts of the business

- This gap is putting pressure on margin and is impacting overall profitability

Margin Variation

- Significant margin variation exists across product types

- Inconsistent pricing and cost-to-serve drive profitability gaps

Eroding Margins on New Business

- New customer revenue brought in at a lower margin than previous product matches

Approach

Unlocking Profitability: Strategic Steps to Optimize Pricing Across the Company

- Data Engineering: Consolidated many ERPs into 1 data set and developed product & customer hierarchies and attributes

- Multi-Step Approach: Led pilot across select locations to fine-tune process, encourage buy-in, and develop a best in class pricing playbook that could be scaled across the organization

- Price Model: Developed statistical pricing models for ongoing price optimization, tailored to specific areas of the organization

- Price Guidance: Provided pricing guidance that includes enhanced segmentation, opportunity modeling, and implementation planning

- Quoting Solution: Built and implemented a tailored quoting application to deliver price recommendations and decision support tailored to specific needs

- Analytics: Deployed centralized, robust reporting dashboards and analytics that consolidated business results, with the ability to view granular details around location, product, customer, etc.

- Cultural Adoption: Stood-up organizational engagement plan, including change management metrics, to reinforce desired behaviors & drive cultural change

Modeling Methodology

Built a tailored model to optimize pricing through enhanced segmentation, delivered via a quoting solution

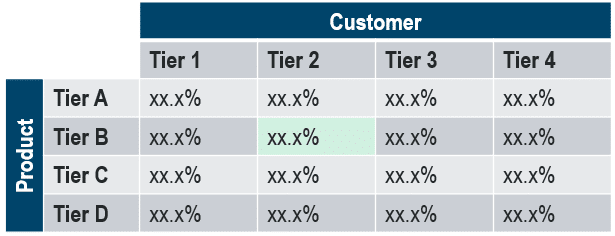

1. Identify Peer Groups

- Based on Customer, Product, and Order attributes

2. Model New, Market-Relevant Price Levels

- Identify market relevant prices based on peer grouping

- Separate margin % target and list & discount transactions

3. Assign Customer Margin Targets

- Green highlight indicates Model Recommendation Percentile

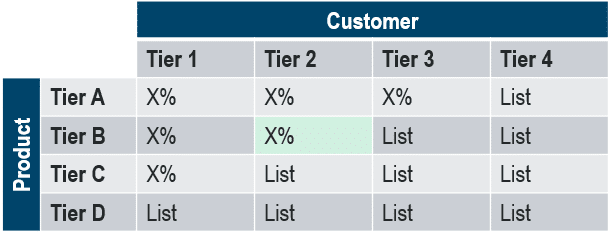

4. Assign List/Discount Price Targets

- Green highlight indicates Model Recommendation Percentile

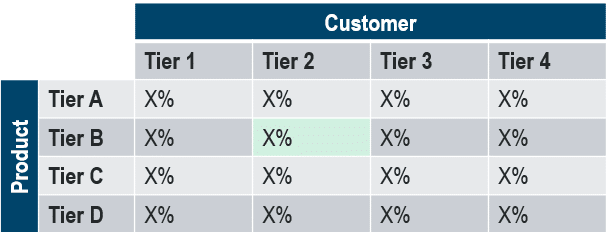

5. Conduct Customer + Item Price Review

- Set price capping to mitigate risk

- Internal teams review finalized recommendations for high visibility and user-based functionality

- Green highlight indicates Model Recommendation Percentile

6. Deliver Price Recommendations

- Integrated recommendation model into quoting application

- Utilized results as an input for measurement and reporting, as well as continuous improvement

- Reinforce desired pricing behaviors through usage and adoption metrics

- Ability to continuously improve model based on results

Technology Solution

Quoting Application

Features:

- Price recommendations based on location, user, etc.

- Ability to develop invoices

- Track open quotes through approval process

- API connection back to ERP

INSIGHT Analytics Reporting & Analytics

Features:

- Dashboards are based on location, user, etc.

- Customizable homepage dashboard, e.g., pricing and quote application usage, individual performance, cost change, etc.

- Margin scatter allows for comparison of revenue and margin % across customers, products, and vendors

Continuous Improvement

Stood up continuous improvement structure to ensure ongoing benefit

Advisory Services

- Measurement: Monthly measurement report on key KPIs

- Model Review & Adjustments: Regular progress review and adjustment plan with ad-hoc analyses to ensure optimization

- Change Management: Regular feedback regarding quoting application and price recommendations, and action plans for areas of opportunity, such as noncompliance

Technology

- Quoting Solution: Execute quoting application enhancements to implement prioritized features

- Data Engineering: Refresh data regularly to maintain consistent outcomes

- Integration: Monitored and managed for stability