Credible Competitive Positioning for Profit Growth

Don't settle for anecdotes, assumptions, and outdated historical information about your competitors when making critical pricing decisions.

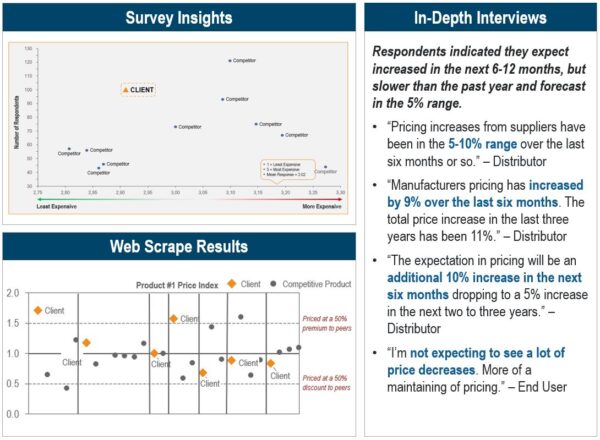

How does my pricing compare with competitors?

Business Scenario

- Limited understanding of price positioning within the industrial market compared to key competitors

- Believed they were priced too high relative to competition and had been more aggressive on pricing historically

Our Approach

- Collected distributor and end user perceptions via

- 20 in-depth interviews with distributors & end-users

- Online survey of 200 end-users

- Competitive web-scrape across 6 distributors

The Results

- Offerings were perceived as moderately priced vis-à-vis competitors

- Most competitors had increased price 10% in the past 6 months

- Prices were not consistently above competitors at key distributors

- Room to institute additional price increases without driving high switching behavior

Sample Market Intelligence Learnings

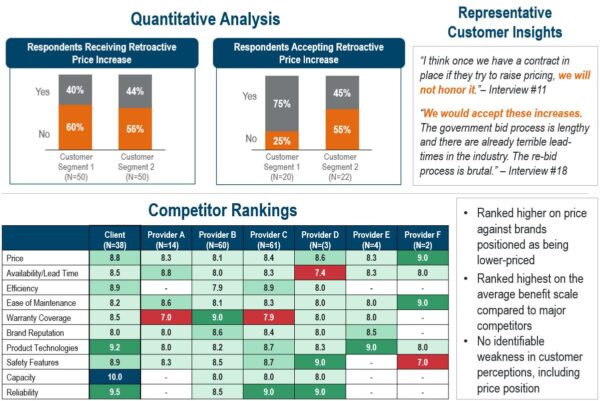

How do my customers perceive my value versus my competitors?

Scenario

- Concerns around competitor pricing, market share, and brand perceptions

- Competing beliefs across the organization around the feasibility and viability of implementing back-order price increases, surcharges, and unforeseen fees

- Unsure what influenced customer purchase behavior

Our Approach

- In-depth interviews to gather primary qualitative research around pricing, brand sentiments, and customer reactions to price changes

- Quantitative phone survey with end users to understand price positioning, key purchase drivers, and brand perceptions

The Results

- Unveiled opportunity to conduct targeted price increases on existing orders

- Proved that current pricing maintains a robust price-to-value proposition in the market

Sample Market Intelligence Learnings

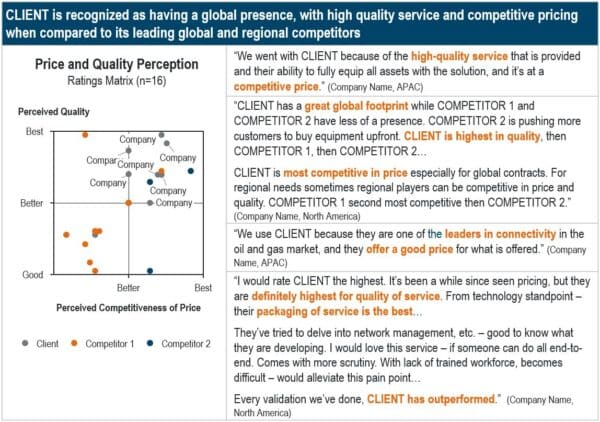

How should I position my value in the market to take pricing actions?

Business Scenario

- Needed objective insights on customer perception relative to competitors on price and service quality

- Required a better understanding of how perceptions varied by global regions

Our Approach

- Completed 23 in-depth interviews with leading current and prospective customers

- Sampled customers in North America, EMEA, APAC, and LATAM regions

The Results

- Internal perception didn’t match the market’s perception – customers believed the business offered the best service at a competitive price

- Competition was limited in most global regions with customers having few options meeting service and performance levels

- Research showed that client could take bold pricing actions with limited risk

Sample Market Intelligence Learnings