Unlocking Revenue Growth's Potential to Maximize Exit Value

Thank you for joining our session at the PE Operating Partner's Forum

Select Learnings From Our Session

- Value Creation with the End in Mind: Businesses spend the last few months getting the data organized and realize too late that they could have done so much more to drive value

- Data Drives Multiples: Developing a strong data foundation will drive growth initiatives and measure financial impact

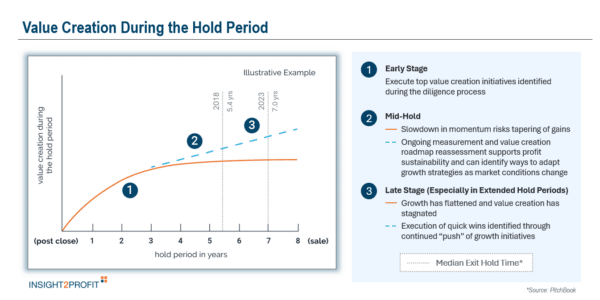

- Sustaining Growth After the Initial Push: Sustain the growth story and demonstrate ability to grow through multiple levers (e.g., not just inflation-driven pricing)

- Buyers Seek Reasons to Believe: Data makes the growth story real and addresses heightened buyer scrutiny

- Driving Value Late in the Hold: Building and maintaining momentum is essential; examples include cross-selling to existing customers, maintaining pipeline momentum, focused pricing actions

Exit Planning in the New Reality: A Structured Approach to Maximize Value

Dive into topics such as:

- The headwinds facing Private Equity are threatening successful exits

- Exit planning challenges: Limitations of the current approach and the need for a more strategic process

- The clear path forward: Exit planning as an extension of the value creation roadmap

- Redefining exit planning to maximize exit value