How To Design a Best-in-Class Pricing Organization

Uncertain, volatile market conditions and inflationary shifts have necessitated that organizations pay close attention to their pricing structure and consider how they sustainably develop and build their in-house pricing capabilities. While pricing has always been an important lever for most companies, post-pandemic inflationary pressure has called for more frequent review and change. Best-in-class companies have evolved their pricing capabilities and are appropriately resourced to address new challenges.

Key considerations when building a high-performing pricing function:

- What are best practices in pricing leadership & organizational reporting?

- What are common organization structures for the pricing function?

The outcome of making such operating model decisions varies across organization, but the strategic focus and intentionality in doing so is common across all high-functioning pricing teams.

What are best practices in pricing leadership & organizational reporting?

High-performing pricing organizations report through a variety of leaders, spanning Chief Financials Officers (CFOs) to Chief Marketing Officers (CMOs). The individual through whom a pricing organization reports is less important than the leader’s credibility and decision-making authority.

First, the right leader will understand his or her organization’s addressable market and price’s role within a broader set of customer expectations. Often, marketing and commercial leaders will develop a comprehensive understanding of how price impacts purchase decisions through both market research studies and practical conversations with sales teams and customers. This understanding not only informs better pricing decisions, but builds credibility with field teams (e.g., sales teams, channel partners, store leadership, etc.) expected to execute pricing decisions.

Second, the ideal leader will understand the organization’s financial reality. It is critical for this leader to understand cost—both the longitudinal trends and the bill of materials makeup. The right leader does not need an extensive finance or cost accounting background but must understand the basic implications to the P&L and how to engage finance and procurement partners to produce succinct and salient facts to justify pricing decisions with sales and field stakeholders.

Understandably, sales and field leaders are often apprehensive about increasing price given anticipated customer pushback and negotiations. The right pricing leader will create constructive dialogue with field / sales leaders by considering others’ reservations and offering compelling facts to drive alignment.

Leaders who harmonize decisions across the organization will improve the pricing function’s influence and impact. When leaders aren’t building credibility and harmonizing pricing decisions, the pricing team will often focus on less impactful priorities and activities. In such cases, pricing teams will over-invest in tasks such as analysis to justify pre-determined decisions or financial-engineering exercises that are not rooted in data or facts.

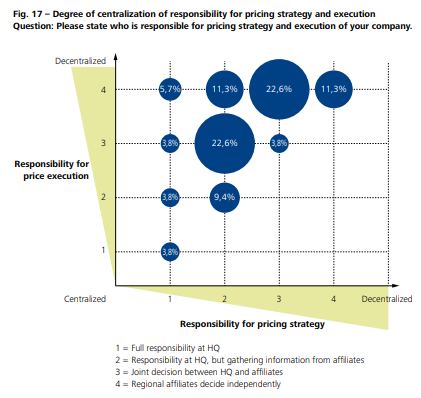

For example, Deloitte conducted a study on the centralization of pricing responsibilities and decisions. They found that most respondents had split responsibilities between regional offices and central headquarters. While this may offer some leverage for regional knowledge, it can also result in the loss of strategic focus and a fragmented customer perception.

This is just one example that highlights the importance of managing the pricing function across the organization. When pricing responsibilities aren’t effectively managed, the pricing team tends to focus on less impactful activities, preventing optimal decision-making and demotivating team members. In such instances, high-performing pricing team members will recognize their lack of impact and career-pathing as members of the pricing function, selecting to leave the pricing function or organization altogether, leading to turnover.

What are common organization structures for the pricing function?

Pricing functions can follow a wide spectrum of structures and designs: business unit dedicated, autonomous center of excellence (COE), and shared-service matrix designs. Each design can be effective depending on industry, channel, and decision-making structures.

Business-Unit Dedicated

This design fits organizations that allocate all G&A / cost-center funding to individual business units, versus allocating a portion to central shared-service functions. This design is common amongst retailers with merchandising teams, CPG within brand management teams, and manufacturing within plants or sales offices. These organizations tend to have autonomous business units with high institutional learning requirements. The upside for the business unit is having dedicated pricing experts with intimate business knowledge supporting their most pressing needs. Pricing team members in this design will receive support from centralized IT or data teams, but are otherwise expected to independently conduct pricing analysis and execution. While the business unit may receive more tailored support, this organizational design isn’t conducive to growing and evolving pricing capabilities and best practices. In addition, hiring decisions may over-index on business knowledge over analytical and leadership abilities.

Autonomous Center of Excellence (COE)

This design is common in organizations that make pricing decisions through single channels using algorithmic approaches. Autonomous COE structures are prevalent across travel & tourism and online retail organizations that set price through online channels / websites. Pricing teams consist of data analytics professionals who develop pricing algorithms and pricing execution specialists who make manual price changes that override algorithm recommendations. This setup enables swift and scalable pricing decisions. However, this design can be challenging to implement when market data is unavailable or unquantifiable. In addition, algorithmic pricing can often provide recommendations that betray psychological pricing (e.g., pricing above $20 or $100 thresholds) or customer expectations (e.g., ‘better’ and ‘best’ products with similar price points).

Shared-Service Matrix

The shared-service matrix is the most common reporting structure and is leveraged across a variety of industries. This structure separates day-to-day business operations from functional areas (e.g., pricing) tasked to support / advise the business. Under the shared-service matrix, G&A / cost-center funding is allocated directly to the functional area with the expectation that they develop best practices and capabilities while supporting business unit pricing decisions. Leading pricing organizations employing a shared-service matrix will assign certain team members to support day-to-day business unit needs, while tasking other members with developing new analytics, datasets, and pricing best practices. This allocation of responsibilities intends to evolve and grow the pricing function’s analytical output and leverage those capabilities to better inform pricing decisions. When this structure works best, pricing team members will build credibility with business counterparts, and leverage new capabilities to better inform pricing decisions in partnership with the business. However, many organizations fail to achieve this goal due to the pricing team’s skill or credibility gaps or the business’ lack of open-mindedness to outside counsel. Strong leadership with credibility and vision helps to mitigate such obstacles.

How to build a best-in-class pricing organization

Best-in-class pricing organizations perform most effectively when their members have clarity and alignment of priorities and proactively collaborate to drive results. Leading organizations also maintain cultural identity and intellectual property within the core pricing team. For example, pricing leaders regularly communicate best practices and learnings by showcasing cutting edge pricing analytics and co-author use-cases for new capabilities.

In addition, pricing leaders will underscore the pricing team’s role as pricing experts and strategic counselors, not ‘yes men’ to the business. This helps pricing teams focus on the business’ most salient commercial challenges while leveraging consistent, data-driven methodologies.

Having internal pricing champions and in-house capabilities is essential to effectively manage pricing decisions. If you’re not sure where to start, INSIGHT can help identify gaps in your existing systems and structures. Then, we’ll partner alongside your team to build clear objectives and steps toward best-in-class pricing. Contact INSIGHT to get started on the path to increased profitability.