Materials Processor and Distributor

Implemented Uniform Pricing Structure to Enhance Profitability

Strategic Pricing Transformation: Driving Profitability in Materials Processing

A $600M materials processor & distributor implemented a structured pricing strategy, negotiation training, and analytics-driven decision-making to enhance profitability.

Focusing solely on volume without a strategic pricing approach led to commercial unsustainability for this $600M materials processor & distributor. The sales team lacked the tools and training to negotiate profitable commercial agreements, resulting in inconsistent pricing and unaligned business strategies. To address these challenges, the company implemented an extensive negotiation training program, leveraged analytics to prioritize key customers, and developed structured pricing strategies. These efforts resulted in a successful 15-20% price increase, delivering $125M in impact over three years.

Explore More Case Studies

Situation

Volume Over Profitability: The Need for Strategic Pricing

- Client was not considering price strategically, and valued volume at the cost of profitability

- Customer accounts had become commercially unsustainable

- Sales team had limited capabilities to negotiate new commercial strategies, including price changes and compliance

- Accounts were requiring upfront alignment with the overall business strategy instead of deciding during negotiations

Approach

Empowering Sales Teams with Data-Driven Pricing & Negotiation Strategies

- Conducted an extensive negotiation training program for the entire global sales team and leadership

- Utilized analytics to identify and prioritize customers worth investigating due to economic value

- Collaborated with leadership to address critical strategy situations, developing plans and coaching to successfully renegotiate deals

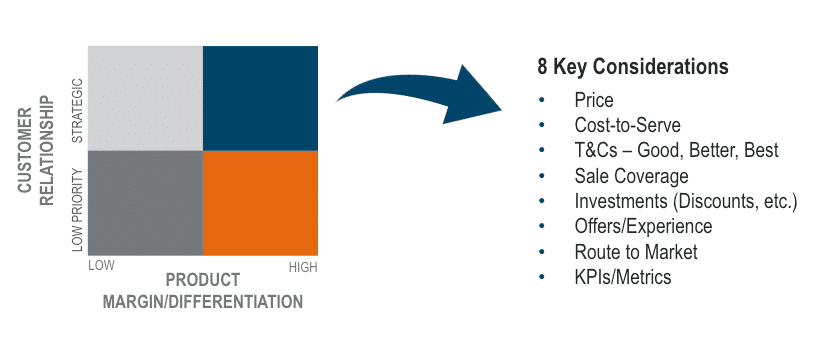

Identify key considerations beyond price

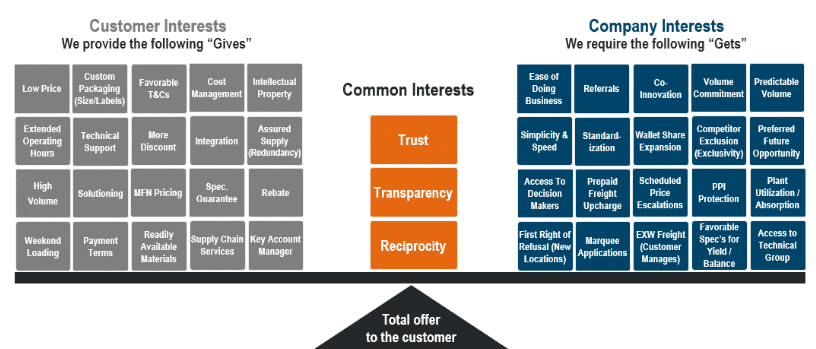

Define the value and cost of “gives and gets”

Executing Price Strategy at Scale

Training, tools, and execution drove significant increases and long-term value

Business Services Case Studies

Quick Wins, Foundation for Value, and Centralized, Sustainable Pricing Capability

Strategic, Market-Based Rate Setting to Drive Profit Growth