Accelerate Commercial Growth

Recently, private equity leaders gathered in Chicago for INSIGHT2PROFIT’s inaugural Private Equity Operating Partners Roundtable Forum to share insights, discuss mutual challenges and celebrate recent successes. We forged new connections and collectively reflected on the volatility of the market trends we’ve endured over the past few years. I’m grateful to have had so many illuminating conversations with private equity leaders. There’s nothing like having the opportunity to learn from other experts, gain new perspectives, and build on each other’s ideas.

That’s why even if you missed the event, I want to share the top 3 takeaways from the summit. This way you can learn what private equity, pricing, and business growth trends you should focus on in the months and years to come to weather all market conditions and accelerate your commercial growth strategy:

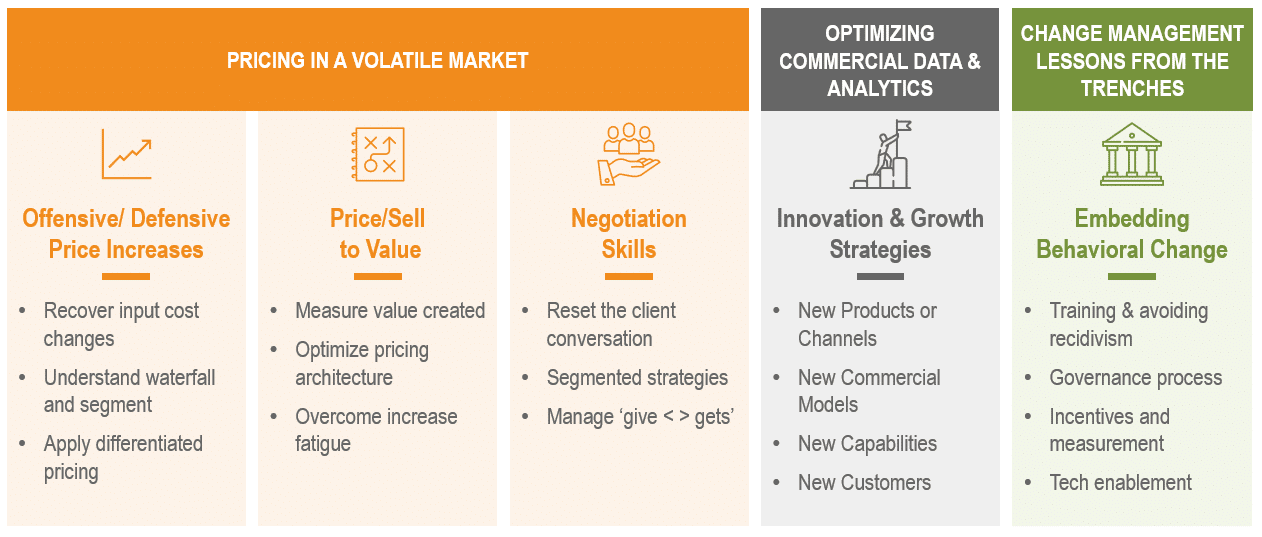

1. Ride the Waves of Volatility: Stay on Top of Pricing Strategy in a Volatile Market

In recent years, executives have recognized the critical significance of pricing strategy due to unprecedented demand growth, supply chain shortages, and inflation. The pandemic accelerated the need for companies to reevaluate their pricing and commercial growth strategy, and with the persistent impact of inflation on profit margins and customer behavior, investing in effective growth strategies has become even more critical. While some businesses adeptly navigated these changes, others are still playing catch-up with the new pricing landscape shaped by inflation.

Leading companies, however, are not content with merely completing a pricing initiative. As demand growth, supply chain shortages, and inflation subside, experts predict another economic downturn may be on the horizon. Given the unpredictable nature of the market, private equity leaders must be prepared to navigate the fluctuations of the general economy and address the unique challenges specific to the industries they operate in. To safeguard their portfolio companies against any future economic conditions, private equity leaders can take additional strategic steps. Keep in mind, it’s crucial to analyze each step in the context of the specific segment, product, and value driver being considered.

- Leverage dynamic data and analytical models to strategically balance offensive and defensive strategies to achieve optimal pricing, rather than simply relying on inflation-driven increases.

- Conduct customer, competitor, and supplier studies to understand how the market is moving, inform your growth strategies, and empower sellers during key negotiations.

- Identify areas of potential profit loss, such as freight costs, rebates, payment terms, and volume commitments, to maximize price realization and safeguard margins.

- Capitalize on long-tail opportunities as demand softens by leveraging niche products and services with lower sales volumes but higher margins, ensuring sustained profits even with lower overall sales volumes.

- Proactively manage renewals, engage deal teams, and leverage negotiation training to cross-sell, up-sell, spread out termination dates, and build moats around your key customers.

- Prioritize innovation, adding value, identifying new features, and developing product roadmaps for current customers instead of focusing on ‘skinnier’ entry-level options to drive new customer acquisition.

2. Expand Your Commercial Data and Analytics Playbook

To accelerate growth in today’s business landscape, private equity leaders are recognizing the importance of enhancing their commercial capabilities and consolidating crucial data before embarking on enterprise research planning (ERP) and back-of-house technology transformations, particularly after mergers and integrations. Implementing a new ERP system can cause significant disruption for lower-middle market companies and may not always yield the desired value.

To maintain sales and thrive in a volatile environment, resilient private equity leaders are making strategic investments to expand their wallet share, boost conversions, improve customer retention, gain insights into cost-to-serve, and optimize inventory to reduce working capital. These diversified strategies aimed at increasing profit margins encompass various approaches, including:

- Sales incentives: Implement a balanced incentive structure that encourages customer acquisition, margin expansion, customer retention, and overall sales performance. Too many existing plans reward inflation-driven revenue growth and need to be realigned with current business conditions.

- Cost-to-serve: Analyze selling, general, and administrative expenses (SG&A) to guide account strategies, protect profitability, make improvements, and adjust service levels accordingly.

- Cross-selling: Examine customer behavior and categorical attributes to identify specific customer groups or cohorts that present opportunities for cross-selling additional products and services.

- Demand planning and inventory destocking: Align supply with demand across warehouses, distribution centers, and stores to maximize fill rates while streamlining stock-keeping units (SKUs) and reducing holding costs and capital investments.

- Sales pipeline analysis: Evaluate the flow of sales opportunities by sales representative and location to facilitate the prioritization of high-value opportunities.

- Churn management: Measuring customer retention, identifying early warning signals and predictors of churn, and developing commercial treatment plans to mitigate risks and maintain customer satisfaction.

3. Lessons From the Trenches: Activate Value With Successful Change Management

A key theme that emerged during our roundtable forum is the importance of truly activating value rather than just checking off tasks when guiding portfolio companies through changes. While certain business transformations may be completed within the designated timeframe and allocated budget, they often fall short of realizing the full value initially promised. Private equity leaders have acknowledged that merely 20% of transformations achieve true success even after a two-year period. How can we reverse this trend and increase the success rate to 80%-100%? To maximize the value derived from every company transformation, consider the following strategies:

- Prioritization: Ensure alignment between your private equity firm and portfolio companies by synchronizing value creation plans and company initiatives, taking into account financial constraints and available resources.

- Governance: Establish a consistent communication cadence to engage leadership during and after the transformation project. The CEO should continue emphasizing its importance even after years later.

- Internal communication: Understand the comprehensive costs and cross-functional impact of launching a new project. Gain early buy-in and resource alignment by incorporating these factors into the business case.

- Ownership: Drive success by implementing a structured process with clear owners, key performance indicators (KPIs), transparency, and accountability. The CEO and CFO may already be overloaded with initiatives, so it’s crucial to assign specific measures of success and KPIs to business units or functional owners.

- Measurement: Set clear and measurable goals to track progress. Establish a revenue/margin waterfall framework for the executive team to assess performance, including pricing goals.

- Positioning: Avoid isolating pricing initiatives; rather than positioning them as one-time investments, position them as elements of ongoing growth initiatives.

- Skills and mindset: Company leadership must take ownership, embrace a change mindset, and possess analytical competence. If needed, consider reshaping the team to align with transformation goals and values. Beware of individuals who say “Yes” but may not truly be committed or capable of championing pricing strategy changes across their company.

Being practical and pragmatic is at the core of INSIGHT’s DNA. We partner with our clients to implement strategies and solutions to ride the waves of volatile economic and industry conditions and create enterprise value in any market condition. In the upcoming blog series, we will delve further into the topics discussed in this post, equipping you with the knowledge and insights necessary to empower your portfolio companies to surf on top of the waves of change and not get dragged under.