Which Pricing Method is Best for Your Business?

The last couple of years has brought many economic changes that forced us to quickly adapt our pricing methods to maintain profitability and meet business goals. While we expect changes to continue – inflation, supply chain disruptions, labor constraints – there are a few fundamental approaches that can help provide a foundation for smart pricing decisions in any situation and continued growth along your journey to pricing excellence. In this blog post, we’ll review the most common pricing methods, steps to become incrementally more profitable, and how to determine what the right steps are for your business.

Cost-Plus Pricing

Cost-plus pricing is the most basic pricing method, and likely the most common. Essentially, you determine your costs for selling a product or service, add a mark-up that meets a margin target, and you have your price. While this is the simplest approach, we don’t recommend it for most businesses because it does come with some risks. First, the costs associated with servicing any customer varies. Changes in raw material costs, volume discounts, and freight costs are just a few elements that can affect your profitability for any single sale and, when aggregated, disrupt business goals. Second, pricing solely based on cost leaves profit dollars on the table for a customer where you have a relatively higher value proposition. That’s why it’s important to price based on the value you provide and customer willingness to pay for that value.

Value-Based Pricing

On the other end of the spectrum, value-based pricing is a more sophisticated pricing method. When successful, this approach sets comprehensive pricing based on certain value proposition factors for specific customer-product or service segments or scenarios. It incorporates all the cost elements at a customer, product, and order level, provides differentiated target margins based on perceived value, and includes competitive positioning to benchmark price within the market. This pricing method is not developed overnight, but it provides a lasting impact to your bottom line. So how do you move from cost-plus pricing to value-based pricing, and is value-based pricing even right for you?

Along the journey to best-in-class pricing, several steps can incrementally enhance your results. Let’s look at a few:

-

- Cost-to-Serve Pricing with Profit Leak Management

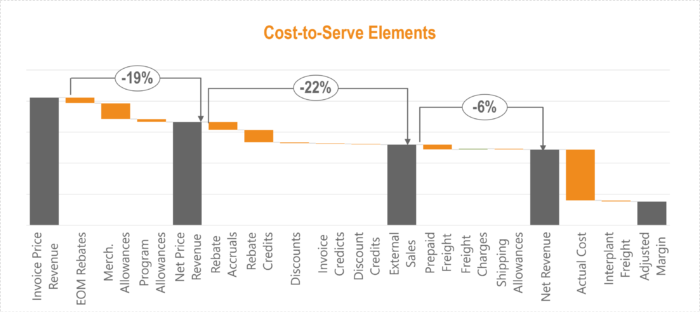

One of the first steps toward value-based pricing is understanding your cost to serve. Once you have visibility to true customer profitability and how every cost and discount off of the original price affects your pocket price, you can begin to identify opportunities to manage profit leaks. For example, you may find a group of lower-margin customers relative to their peers (e.g., similar sized and tenured customers) who may be receiving discounts they don’t deserve. You may find that certain programs are not as profitable with certain customers as you thought. Or that your sales team is giving volume discounts to get a sale – leaving that sale unprofitable. When you understand your true cost to serve, you can begin to manage price based on customer factors instead of a flat cost mark-up and start to reduce leakage from your historical pricing actions. - Differentiated Pricing using Customer Value Perception

How sophisticated is your customer? How significant is your product or service to them? How complex is what you do? What value do you provide that makes you unique? How does that value perception change based on the customer you’re selling to? These questions begin to help you segment your customer base into groups that enable differentiated pricing by incorporating what we call value drivers into your pricing method. Here’s an example: A manufacturer of building products was unknowingly severely underpriced in the market. With minimal data to rely on, the business leveraged tenured sales management for pricing guidance. Costs were heavily tied to steel and affected by market fluctuations. List prices hadn’t been updated in years and front-line sales had the authority to discount. Through historical data analysis and internal interviews, we identified several key value drivers such as product tier (good/better/best), product type (standard vs. special), customer size, and customer type (builder, big box) that allowed the manufacturer to create peer groups or segments. Price targets could then be deployed within those peer groups, generating differentiated pricing based on unique factors. With our partnership, the manufacturer went on to experience over $100M of impact (~25%) to their bottom line. - Market-Based Pricing using Competitive Positioning

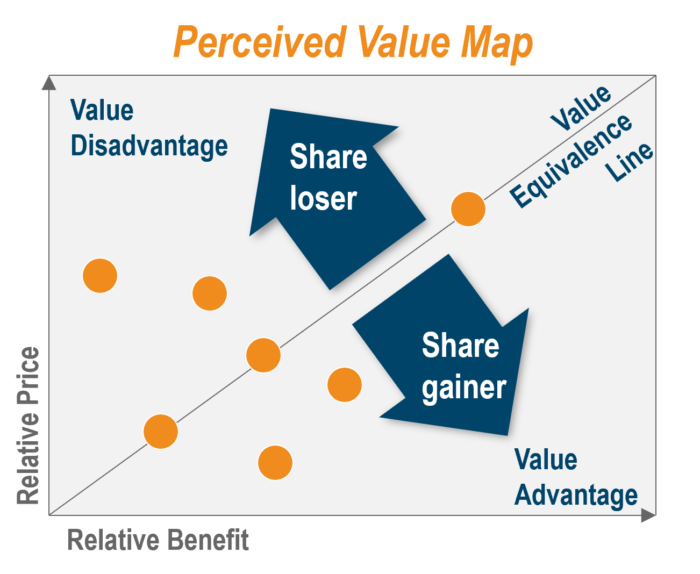

Another step to enhancing your pricing method is to incorporate competitive factors. Depending on your type of business, this market-based pricing may require deep external market research through interviews, web-scraping, or ongoing capture of quote data. Whatever the method, incorporating competitive information allows you to build your perceived value map (see below). When compared to your competitors, are you at an advantage or disadvantage? Once you understand this mapping, this information should be incorporated into your overall approach through the value drivers and differentiated pricing method described above. The aforementioned manufacturer went through a similar process. Through customer surveys and in-depth interviews, we conducted a competitive analysis to understand where they were priced lower or higher vs. their competitors. We then performed peer group comparisons and used them as an input when setting new market-relevant list prices across product groups, and leveraged competitiveness as a factor when generating new quotes.

- Cost-to-Serve Pricing with Profit Leak Management

The journey to value-based pricing can be long and complex – and it may not be the best method for your business right now. These incremental steps can help you price smarter and provide profit gains for further investment in your pricing organization.

To help understand where you are in your journey, we’ve gathered 8 questions to help assess the amount of opportunity that may exist in your business to introduce one of these pricing methods:

- Are you successfully able to readily leverage the data in your business to make data-driven pricing decisions?

- Are your prices and/or historical price changes keeping up with costs?

- Is the authority to change price (including discounts or other price reduction promotions) managed by a centralized few? Does technology play a role in supporting these processes?

- Do you segment your customers as a way to differentiate price? Do you regularly review and update that segmentation?

- Do you have visibility to the profitability of all your cost to serve elements, such as freight, rebates, discounts, payments terms, marketing allowances, promotions, etc.?

- How frequently do you review or update pricing or ancillary programs?

- How much market visibility do you have to competitive factors? Are you capturing that data in a usable manner?

- Do your reporting tools and processes efficiently and effectively allow you to manage price performance?

If you answered “no” or “little” to any of these questions, that probably signals there is an untapped opportunity in your business to enhance the approach you are taking today.

Not all of these pricing methods may apply to your specific business, but that’s where INSIGHT can help.