Is Volume Decline Causing You to Rethink Your Pricing Strategy? Here’s What to Do

Organizations across a multitude of industries are facing volume declines, causing them to rethink their pricing strategy. Although some of these shifts in volume have been expected, there remains a lot of alarm and confusion around the underlying cause and how to best address it.

It’s easy to assume that price plays a major factor, especially for companies that conducted bold price changes the last couple of years due to inflationary developments and cost increases. While price may indeed play a role, the story is often more complex and warrants a deeper review. The worst thing most businesses can do in this scenario is apply a flat price decrease across the board without the data and confidence to back it up. If your volume has declined, or you expect it to, it’s important to ensure your response accurately reflects the current state while supporting your strategic goals.

Understand how your pricing strategy is affecting volume changes

Many organizations with volume decline are wondering if they’re losing market share, if the market softened, or both. However, in order to understand what’s going on with your volume, businesses need to first understand where it’s occurring, and then assess why. Volume changes can happen for different reasons in different areas of your business, and your response should be equally as surgical as your analysis.

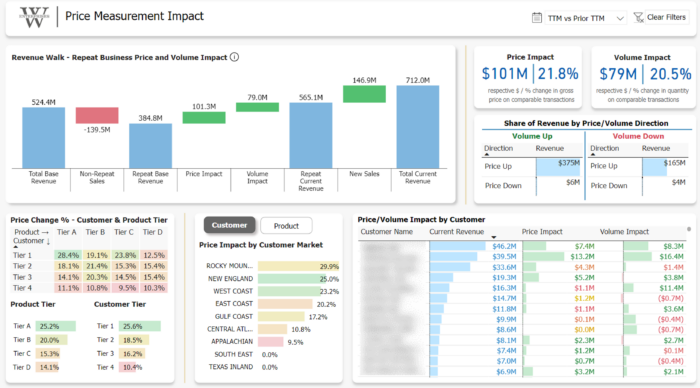

Price measurement analysis to understand where volume decline is happening

The first step in addressing unwanted volume decline is understanding where exactly it’s occurring. It’s not enough to look at overall sales trends—companies need to understand if volume changes are happening in certain regions, product lines or types (e.g., luxury vs. generic, configured vs. resupply), customer tiers, end markets, or other areas of your business. This will help surface the areas that call for higher attention and review. Price measurement analysis can bring visibility to your business’s performance through dynamic data cuts and analyses, such as a revenue walk to track where changes in volume have contributed to changes in revenue.

Once you have access to the data, it’s crucial to understand if and where price may be offsetting volume. If your overall revenue is up, but volume is down:

- What role does this play in achieving your sales goals or strategic business goals?

- Are there certain areas of your business (products, customers, or regions) where this matters more or less?

- Is revenue or margin more important for your business goals?

Answering these questions is a critical first step to understanding how to respond to volume changes.

Market research to understand why volume decline is happening

Many businesses are eager to understand why their volume has changed, especially when it’s affecting business goals. One of the most effective ways to detect why an organization is experiencing volume decline is through a market research study. Market intelligence can reveal an array of learnings, such as:

- Purchase volume trends and factors impacting customer purchase frequency

- Customer purchasing criteria, including what role price plays

- Factors that cause or prevent customers from switching suppliers

- How customers perceive a business relative to competitors

- Recent price increases customers have seen from competitors

Understanding these details enables accurate interpretation of customer behavior with hard facts.

It is also advantageous to understand if and how much share you might be losing to competitors. A competitive intelligence study can answer two crucial questions:

- Are customers switching to competitors (losing share), are they buying less (market decline), or is it a combination of both?

- If customers are moving to competitors, what is the root cause? Is it due to price, or have they switched because of better product offerings, quality, or service?

We recently completed a competitive intelligence study with a specialty distributor to answer these two questions.

Business Situation:

- A specialty distributor had seen unwanted volume decline compared to the previous year

- The business believed the decline was due to its price increases leading to it being priced higher than market competitors

- They planned to pursue price cuts to improve volumes, but needed to validate whether volume was down due to overall economic conditions, price misalignment, or both

Solution:

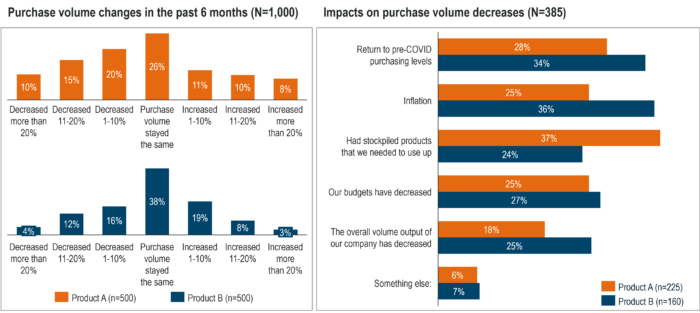

- INSIGHT developed and executed a survey of the business’s declining and lapsed customers to investigate purchasing volume trends and drivers

- We learned that customer volume had decreased largely due to changing economic conditions

- We also gained clarity on factors that had led customers to purchase from other suppliers

From the following data, you can see:

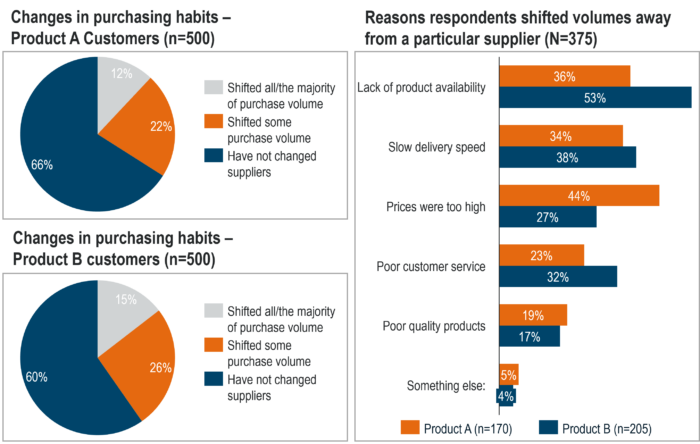

- Majority of Product A (66%) and Product B (60%) purchasers did not shift volume between suppliers

- Indicates changes in purchase volume not due to loss of business to competitor in majority of cases

- Product B customers shifted suppliers due to product availability, delivery speed, and price

- Price was a bigger trigger of switching amongst Product A customers

Outcomes:

- Since the majority of volume declines were driven by softer market volumes rather than lost business, the distributor had confidence to execute less aggressive downward price adjustments

- We isolated where price was a major factor in lost volume to conduct more surgical pricing actions

If this distributor had conducted the aggressive price decreases they initially planned across all customers, they would not have seen the growth they expected because volume decline wasn’t strictly due to price. In the end, their price decreases could have resulted in lower margin and revenue overall with minimal volume improvement. Understanding the facts behind customer behavior was key to making the best pricing decisions for their business.

How to adjust your pricing strategy to address unwanted volume decline

The actions you take to address unwanted volume decline are dependent on your data analysis and market research findings.

First, it would not be beneficial for organizations to conduct flat price decreases. By doing so, you risk further margin and/or revenue decline if you sacrifice price where it was not the major factor affecting volume changes. Instead, carefully assess where price has become the issue versus other factors at play. Remember, best in class pricing organizations price and sell their offerings based on the value they deliver versus utilizing a cost-plus pricing strategy

Second, organizations will benefit from implementing more surgical price adjustments and other pricing actions. There may be areas of your business where you should continue to conduct your standard price increases due to market conditions. For other areas where costs may have come down, it may make more sense to implement a mindset of holding price, especially if costs remain higher than pre-COVID levels. Either way, the key is to be more prescriptive with your pricing actions to ensure your price reflects your value.

Take this example of a consumer products manufacturer:

Business Situation:

- A consumer products manufacturer had declining volume versus the prior year and needed to understand factors driving the trend

- In addition, they recently made changes to how they advertise and promote features of certain products and wanted to understand what role this played, if any, in volume changes

Solution:

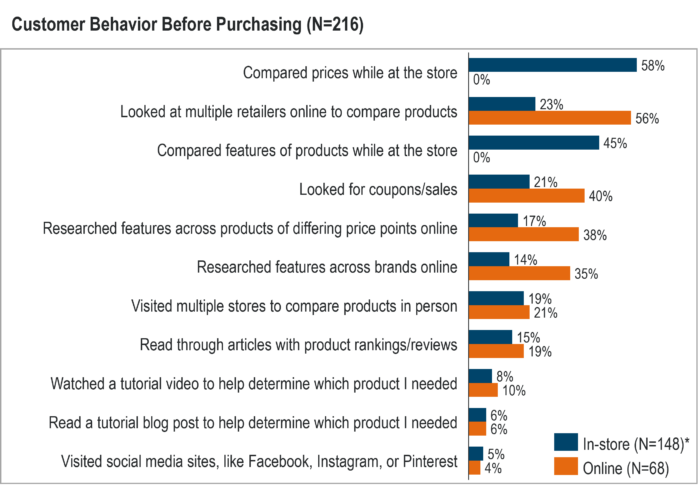

- INSIGHT conducted a survey (n=216) of customers who were confirmed purchasers of specific products in question within the last 6 months

- We gained a clear understanding of how the manufacturer’s brand is perceived compared to competitors, and which competitors to benchmark against

- We determined customer key purchase criteria and preferences relative to select product features, uncovering areas where pricing was not aligned to value drivers

- We also received insights on path-to-purchase and role of advertising and promotional methods

Key Takeaways:

- The most common consumer behaviors before making a purchase all related to product and price comparisons, with the 3 most frequently mentioned responses being: “compared prices in-store”, “compared products online at multiple retailers”, and “compared product features in-store”

- Learned most consumers were currently purchasing opening price point products

Outcomes:

- The manufacturer adjusted promotional spend where dollars were less impactful on volume

- They also tweaked value laddering in their pricing model to better capture value

- The company increased focus on opening price point products to capture shift in consumer preferences

Sometimes there are circumstances where it makes sense to give back price. In this case, be sure to consider where you want to invest.

- Which customers or products are most valuable to your business?

- Consider all the factors going into a customer’s price and how you want to distribute the decrease—list price, discounts, freight, payment terms, rebates, etc.

- Apply price reductions only to those identified segments of your business that require it, and maintain differentiated pricing

- Ensure customer communications capture your value proposition to minimize being seen only as a cost line item—and make sure you continue to deliver on your value proposition

For additional resources on this topic, our post How to Protect Price and Profitability Amidst Market Volatility reviews various cost and demand scenarios your business may be experiencing and how to best respond.

M&A: Are you buying or selling a business with volume decline?

If you are evaluating a business for sale or purchase and find undesirable volume decline, the same data analysis and market research can be performed to assess value and determine the most constructive next steps. Keep in mind that volume decline can indicate areas of pricing opportunity and growth—but it should be assessed carefully.

INSIGHT’s Quality of Pricing offering can help businesses quickly understand and validate pricing opportunity. In as little as 2 weeks we can make sense of the data to determine where volume declines are most impacting the business and where there is growth opportunity—backed by quantitative and qualitative data you can rely on.

Adjust your pricing strategy successfully with INSIGHT2PROFIT

No matter how much you expect it, volume declines can threaten even the strongest organizations. Fortunately, arming yourself with the right data and insights can help inform the best pricing strategy for your business to successfully navigate through volume challenges.

If you have questions about your volume or pricing strategy, INSIGHT2PROFIT can help. Our expert data engineers will dig into the details of your data to uncover what’s really happening in your business. Then, our market intelligence specialists will uncover market-based insights to provide the confidence you need to make informed business decisions. We’ll then partner with you to craft and implement a tailored pricing plan that aligns to your business needs. Contact INSIGHT to answer unknowns and take action with confidence.