Private Equity and Inflation: How to Navigate Profit Margins in a Time of Rising Rates and Costs

In Private Equity, there is always more that can be done to optimize your investments – and as soon as you’ve caught up, something shifts. An inflationary market exacerbates this experience, forcing firms to move quickly across the portfolio to address rising costs in different industries, channels, and markets, and with a host of competing priorities and unique caveats along the way.

The Private Equity industry exists to make businesses more profitable and drive enterprise value, but today’s environment increases the pressure to react swiftly to changing costs and other constraints that jeopardize both existing and future profit growth.

We know that this market is more accepting of price increases, and we’ve seen businesses successfully implement price changes at 2-4 times their normal rate just based on cost increases alone. But with costs continuing to rise – and then fall, only to rise again somewhere else – relying on price changes alone may not be the smartest approach. While imperative to an overall pricing strategy, there is a point at which conducting yet another price adjustment isn’t enough or doesn’t truly solve the real underlying challenge within your portfolio company.

Instead, imagine you have a pricing playbook. This playbook provides step-by-step guidelines to address key profitability challenges based on the scenario at hand. Then imagine the market shifts again, and you’re facing more debt even though you’ve barely recovered from the current state. Pricing is simple, right? Rising costs? Raise price. Cut costs. Capture value. Train and reward the sales team. We know these tactics in concept, but in reality it’s never that black and white. With the right playbook, navigating these changes and the complexity that goes along with it can be done strategically, confidently, and backed by data. To get started, we’ve compiled a handful of practices to support profit margin growth when rising costs and a volatile market are at play.

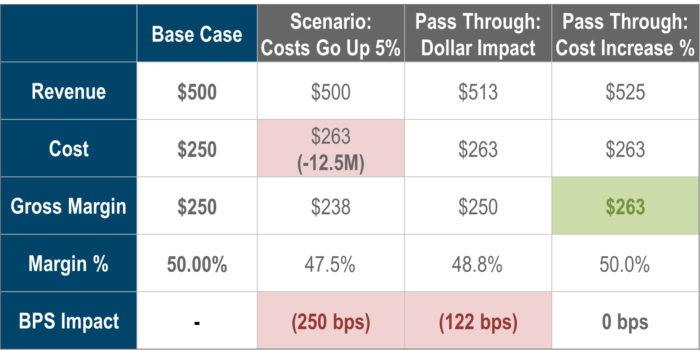

Economics of a Cost Increase

First, regular price reviews and adjustments are the cornerstones to a successful differentiated pricing strategy and profit growth. This is easier said than done. There’s a lot of complexity that goes into executing any price increase, from managing a sales team approach, balancing customer expectations, and ensuring your strategy is directly aligned to your goals – not to mention the changing market conditions. Your portfolio companies need to know how to use price changes to recover from cost increases, to execute it swiftly and without disruption, and you need to see results directly to the bottom line to ensure profit margins stay on track.

If you aren’t currently conducting price adjustments, this is your permission to begin doing so. Every month you delay passing a cost increase to your customers costs the business – you must act quickly.

Common mistakes when implementing a price increase:

- Not knowing the economics of a cost increase

- Progress vs. perfection

- Failure to make a timely call

- Communication vs. negotiation

- Lack of preparation

- Not being resolute

- Not tracking price execution & realization

Other Levers to Mitigate Rising Costs

Within pricing, there are many dials to turn to address rising costs in addition to price increases. Look to other factors in your profitability to stop profit leaks and the historical behavior that keeps leaks happening:

- Standard Discounts: When was the last time you evaluated if customers earned discounts?

- Manual Discounts: What authority does customer service have to adjust?

- Quantity Breaks: Are quantity breaks driving economies of scale?

- Contract Pricing: Are you updating contract prices and terms when you do a price increase?

- Promotions: Do you need promotions in this environment?

- Rebates:

- If your rebates are based on revenue, do you change the rebate goals when you raise prices?

- Are your rebates growth-based or volume-based?

- Payment Terms: What behaviors are you rewarding?

- Credit Card Fees: Do you charge these to the customer?

- Freight Fees: Does your freight policy serve your bottom line?

- Commission Structure: Do you reward the right behaviors that align with business goals?

But what’s the best way to incorporate these costs into your pricing strategy? Here’s one way to think about some of these factors:

Discount Management

Unearned discounting is one of the first places to go to help stop the bleeding, so to speak. Ask yourself:

- Do you differentiate discounting by customer, products, or order factors?

- Do you have to be discounting?

- Do you understand discounting behaviors by rep?

- Do you have reps discounting more? If so, why?

Flat discount rates, just like flat price increases, leave money on the table and can even cause customer entitlement. The discount associated with a customer price is a part of the value delivered and should be handled just as carefully as the price itself. Yet, we find that many businesses inadvertently give their smaller customers better deals by not managing unearned discounting and focusing too much on ‘landing the deal.’ This sort of practice erodes at profitability. While volume is important, the mix of price and volume provides a more accurate interpretation of results and overall impact. Most of the time, businesses are unaware this is occurring in their business – would even argue that it isn’t – due to limited measurement and analytics capabilities.

Take this example: We partnered with a distributor who felt they did a good job of always passing through cost increases and trusted their expert sales reps – and their margins were fine. While they did not expect to see much price mismanagement, the data showed significant price and margin variation across peers, largely due to decentralized management of discounting that gave the commercial team ownership. We partnered with this portfolio company to establish new list prices and a discount matrix with approvals that now sits within their ERP quoting process that all team members are required to use. With built-in sales team incentives via commissions, both the company and the sales team saw financial benefit.

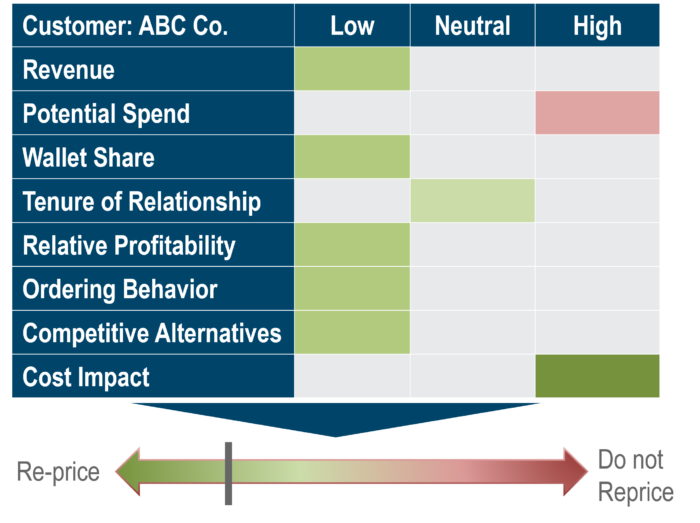

Addressing Backlog

If your company is experiencing a backlog of customer orders due to an increase in demand and/or a decrease in supply or resources, there are a few actions you can take now to help mitigate capacity constraints.

- Evaluate your customer portfolio

- Who are your most valuable customers?

- Do you understand your cost to serve and the reasons behind low-margin customers?

- Are you prepared to let go of relationships that may not be serving you?

- Make pricing and operational adjustments

- Can you identify ancillary pricing elements you can change quickly?

- What customers can you group into pricing action buckets, e.g., re-price, eliminate promotions, decrease discounts, service-level changes, order fee adjustments, freight policy changes?

- Communicate with customers

- What is the timeline and communication plan?

- How are you rolling it out to the sales team and providing coaching?

- Put controls in place to ensure each new order conforms to new policies & terms

Freight Pricing & Terms

It’s no secret that freight pricing is a moving target – and it’s often one of the largest price leaks for companies. Assessing if and how your current freight pricing is working for – or against – you is critical to stopping this leak. Understanding transaction-level freight revenues and costs, both inbound and outbound, allows for intelligent freight management. Freight is margin eroding when your organization has not invested in necessary freight analysis. Also, be careful not to use freight as an easy giveaway to customers, but instead engage in a healthy dialogue about what can and cannot be done to meet their needs while safeguarding profit margins. Clear policies and approval processes will ensure freight isn’t misused and your customer service is balanced with flexibility in the field and guardrails to protect against profit drops.

Contract Pricing & Terms

Current contract terms may not legitimately allow you to change pricing mid-contract cycle. If negotiating current pricing isn’t an option, take steps to prepare well in advance of renewal dates with price increase amounts, up-front communications, and clear causes for price increases that tie back to your value proposition. Also, consider updating your terms to include language that allows increases mid-cycle for certain scenarios moving forward.

When negotiating price changes, begin by creating a database by customer contract that includes items such as pricing, rebate logic, payment terms, late payment fees, delivery service, and other terms and conditions. Then, define what a negotiation package looks like:

- What has been the historical financial performance with this customer?

- Where do they rank with terms & conditions vs. peers?

- What is the competitive landscape?

- What points of negotiation resonate with this customer?

Last, establish your negotiation strategy – what is your ‘going in’ position and desired ‘landing spot’, and who is responsible for what activities throughout the negotiation process? Before doing any of this, make sure the team is trained, supported, and confident in their ability to execute.

Execution is Key

You can set the best strategy in the world, but execution is where the money lives. Here are 3 short tips to aid the implementation of any of these profit-garnering tactics:

- Empower Your Team

- Do you have a way to engage and establish buy-in with your team?

- Do you provide customer communications, FAQs, and other talking points?

- Do you have a data-driven rationale, through historical data or market research, to support these changes?

- Measure Activity

- Do you have visibility to what you are asking for?

- Do you have the ability to track announced changes vs. realized?

- Put Incentives in Place

- How are your incentives helping your team achieve their goals?

- Should you consider incentives like kicker programs?

Manage Profit Margins Despite Rising Costs

If your portfolio companies haven’t yet undergone a price adjustment to address rising costs, now is the time. If those price increases aren’t cutting it, there are other pricing tactics you can use to mitigate the risk of profit erosion.

- Now is the time to assess your ability to raise price

- Be proactive with your cost estimation

- Challenge your norms

- Stop unearned discounting

- Explore where profit leaks exist in your business

- Align your team for price change execution

If you aren’t sure about the best route for your business, contact INSIGHT2PROFIT to quickly assess where you might be losing money and suggest the best path forward to manage – and even increase – your profit margins.