7 Pricing Strategy Misconceptions Debunked

Effective price management is one of the fastest and most consistent ways to maximize profits. Yet seasoned executives, finance leaders, and salespeople alike often hesitate to implement pricing strategy initiatives due to tightly held beliefs about pricing that are myths.

Failing to optimize your pricing is a costly mistake. If your pricing doesn’t reflect your value in the marketplace, you risk leaving money on the table. When executed correctly, strategic pricing is one of the most valuable profit levers in an executive’s toolbox. On average, a 1 percent improvement in price can increase your operating profits by 11%. Why, then, are business leaders shying away from fully leveraging such a material instrument for growth?

In this blog post, we review 7 strategic pricing myths that are holding many organizations back and common beliefs you should avoid if you want to strengthen your price management practices and maximize profits.

Myth #1: There is no problem with our pricing

Accepting that your pricing is not as optimized as it could be is one of the biggest hurdles to growing profits. If you don’t have visibility to how much profit you’re losing due to inadequate pricing, why would you try to improve?

Even businesses that have been employing pricing strategy initiatives for years have ongoing opportunities for price optimization. This often arises from:

- Market changes that affect cost, demand, price elasticity, channel strategy, end markets, customer segmentation, or product positioning

- Growth in your business that affects sales structures, operational procedures, target markets, or product development

Even small changes in your customer base or sales organization can affect your pricing model, cause price leaks, and trigger the need for price optimization.

An outside pricing consultant or software solution may help provide an objective understanding of the pricing opportunities available to keep you from missing out on profits. Utilizing these tools can reveal pricing opportunities such as price leaks or margin erosion that can better position you for profit growth.

Myth #2: If I increase prices, I’ll lose customers

Alienating or losing customers is a very common fear. The hard truth is, if you increase prices, you might lose some customers. However, a crucial factor in managing customer churn is making sure the value your company provides is clear to and valued by your customers. Consider that losing price-sensitive customers can be more beneficial than you realize. Price reflects both cost and value; it is possible that highly price-sensitive customers aren’t delivering value to you. They could be bringing in lower margins, have a high cost to serve and may not accept pricing corrections. Cutting your losses on negative-margin customers boosts your profitability, and your sales team can focus on managing and bringing in more high-value customers.

Also, keep in mind there are more factors at play for your customers than just price. For example, switching to a new provider could be more costly and time-consuming than staying with your company, despite the price increase. Market studies can reveal what your customers value most, and help you build pricing solutions that are adjusted for risk based on findings.

Myth #3 Meaningful profit growth only comes from increased volume

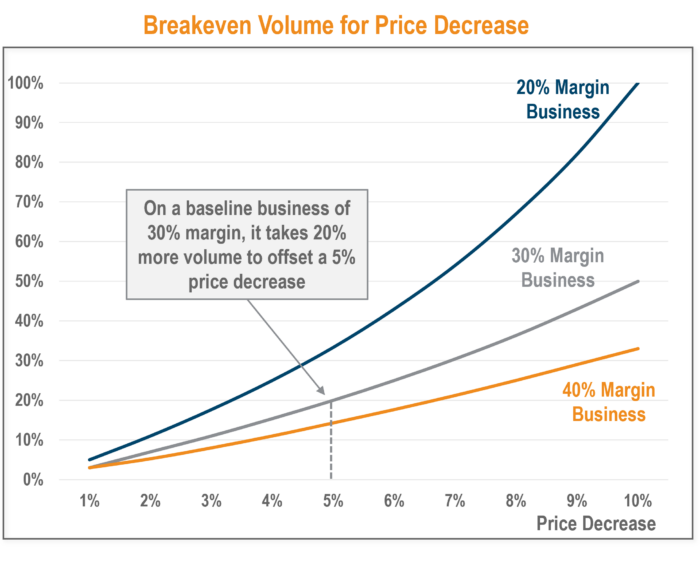

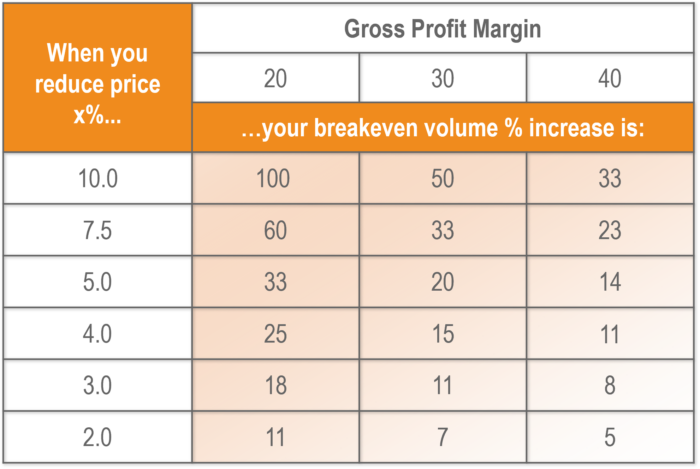

Another reason executives are inclined to keep prices low is the hope of achieving more sales volume and capturing greater market share. However, keeping prices low too often comes at the cost of generating a sale, even if it’s not good for your bottom line. Keep in mind that profit growth is a product of price and volume, and a reduction in price requires a much higher increase in volume to offset—often a 2-5x multiple. This puts a strain on your sales team and can inadvertently lead to a need to reduce operating expenses, which is counterproductive to profit growth.

Cost-cutting and sales volume increases are important but must be kept in balance by price optimization. By implementing differentiated, strategic price management solutions, you can be more profitable with certain customers than with a greater volume of customers all paying a lower price. Studies have shown that companies who strive to beat their competitors and wrest away as much market share as possible, often find the overemphasis and effort can be detrimental to profitability. By contrast, companies whose goal focused on maximizing profits posted stronger returns on investment.

Myth #4: Cost-plus pricing is the safest pricing strategy

Cost-plus pricing is setting the asking price at a set percent markup, e.g., 30%, on the total cost of producing one unit of a product. This is a popular pricing method because it’s simple to use, covers costs, and is easily justifiable to customers. Plus, it may be the way you’ve always done it and feels very familiar.

However, relying solely on cost-plus pricing can result in profit loss and overlooked profit potential. A cost-plus pricing approach fails to consider important factors such as market trends, customer willingness to pay, competitive positioning, and overall demand. Moreover, it can complicate price management when material and labor costs fluctuate, leading to confusion and frustration among customers.

Numerous strategic pricing alternatives exist to counter the limitations of cost-plus pricing. Although each option possesses its own advantages and disadvantages, it is crucial to invest time in identifying the optimal approach for your business to maximize profitability.

Myth #5: Our pricing is our competitive edge

If your sole competitive advantage lies in offering a lower price than your competitors, you may face a greater challenge beyond managing pricing effectively. Strong pricing organizations are not built on the foundation of always being cheaper than the competition. While understanding your competitive landscape is an essential aspect of strategic pricing, relying solely on this factor puts your business at risk. A competitive edge encompasses more than simply undercutting prices; it involves demonstrating that your company delivers superior value through qualities like, features, benefits, conveniences, or customer service compared to the competition. Once you have a deep understanding of your customers, you can tailor your offerings, messaging, and pricing to cater to their specific needs.

If price alone is enough to discourage a significant portion of your customer base, it is likely indicative of another issue. In cases where customers are highly price sensitive, your pricing model should account for these attributes and adjust price and margin recommendations accordingly. However, as a general principle, your pricing should align with the value you provide and the unique differentiation you offer in the market. By leveraging data such as market insights, customer preferences and product details, you can establish a competitive advantage that extends beyond pricing. Optimize your pricing strategy based on the distinct value you bring to the table.

Myth #6: Our pricing strategy is sufficient; adjusting it will be too complicated

While it is true that adjusting your pricing can be a complex endeavor, the ultimate outcome of higher profits is not only rewarding but often crucial for the success of your business. Shifting market dynamics, competitive landscapes, and evolving business objectives necessitate organizations to adapt their strategic pricing approaches to ensure continued profitability and growth. While it may seem complicated, the risks associated with not adjusting your pricing outweigh the time and effort required to implement price management solutions that consistently maximize profits.

Implementing a comprehensive price optimization solution entails a dynamic pricing model capable of swiftly and accurately adapting to market and business fluctuations, alongside pricing software solutions that streamline and systematize pricing processes. While this approach may demand initial investment and effort, it establishes a robust and agile foundation for long-term profitability and growth.

By partnering with the right pricing experts and leveraging effective pricing solutions, you can develop an approach that minimizes disruption to your team and customers while yielding a return on investment that aligns with business objectives.

Myth #7: Our sales team knows best

If this myth resonates with you, it’s likely that your sales organization possesses a wealth of invaluable insider knowledge and irreplaceable judgement. However, positioning your business for both short- and long-term success requires centralizing and harnessing that knowledge through standardized procedures and processes that support a world-class commercial organization. Relying solely individual salespeople to make pricing decisions exposes your company to several risks, including:

- Customers receiving inconsistent pricing and/or mixed messaging, which can undermine company goals and value positioning.

- Granting better deals to low-margin or negative-margin n customers compared to counterparts.

- Acquisition of new customers with varying reference price levels.

- Misalignment in defining “strategic” accounts as individual salespeople prioritize their own portfolios.

- Overemphasizing volume at the expense of profitability.

- Critical customer and sales knowledge leaving with the departure of a salesperson.

Your sales team plays a vital role in driving profit growth and should be recognized accordingly. Therefore, it’s crucial that your pricing and sales organizations work together toward a centralized governance structure that leverages and promotes the knowledge of the sales team while maintaining alignment with the financial goals of the business.

How to Maximize Your Pricing Strategy with INSIGHT2PROFIT

To unlock growth and maximize profits, it is essential to challenge the misconceptions surrounding strategic pricing that may be hindering your company’s progress. While it may seem daunting to change your current price management practices, especially if your business is operating sufficiently, there are substantial risks associated with not regularly optimizing your pricing; these risks far outweigh the potential loss of a few customers.

Adopting a world-class strategic pricing approach allows businesses to navigate their own unique complexities, mitigating the risk of customer or volume erosion. By working with a partner who can help you implement a pricing solution that sustains long-term profit improvements, you can effectively respond to market shifts while aligning with your business goals. This entails understanding your customers, considering the value you deliver and implementing a pricing strategy that evolves with changing dynamics.

Take the first step toward pricing excellence by CONTACTING INSIGHT2PROFIT. Discover how to dispel these common pricing myths, embrace optimal pricing practices, and embark on a journey to unlock your company’s full profit potential.