Cost to Serve Analysis: How to Remedy Price Leaks and Margin Shifts That Are Hurting Profitability

In market conditions that aren’t as favorable to standard price adjustments, there are many other pricing solutions that you can—and should— take to ensure your pricing organization stays profitable and your goals stay on track. One of these areas is cost-to-serve analysis and price leak management.

When working on a quote or price list for a customer, how often are you factoring in potential costs like discounts, freight, program allowances, rebates, or payment terms? Do you know how much of that price actually reaches your bottom line after the costs incurred to service that customer have been stripped away?

To accurately forecast your pocket margin and determine a customer’s value to your business, you first must understand the cost of serving that customer as you move through the supply chain. A cost-to-serve analysis examines customers on a granular level and digs deep into the data to reveal their true value—or expense. This information is pivotal when trying to drive growth and improve your bottom line.

What are the Benefits of Cost-to-Serve Analysis?

Cost-to-serve analysis gets to the heart of profitability. When you take the time to calculate a customer’s actual value, cost to serve reveals the impact of price variations and price leaks as it pertains to customer relationships, locations, products, and channels.

By using cost-to-serve analysis to segment customers by their profitability opposed to their tenure or topline revenue, pricing leaders can learn which of their customers and product types are in the green, and which are in the red. From there, cost to serve can be utilized to implement targeted pricing actions that positively affect margin, as well as surface undetected price leaks to inform how pricing programs should be adjusted based on factors like overhead costs incurred from serving that customer.

What are the Most Common Price Leaks?

A price leak happens anytime you provide value but don’t get paid for it. Understanding how to find and fix those price leaks is critical if you want to achieve continuous profit improvement for your organization. These price leaks can occur through:

- A variety of types of discounts for a specific customer or transaction

- Slippage through fees or policies that are not set at appropriate levels or well-enforced

Common Discount-Based Price Leaks:

Rebates

As time passes, customer rebates can start to feel more like entitlements. When this happens, what was once a profitable deal can become harder and harder to change, even when it is no longer profitable for the company. Additionally, a rebate structure that accounts only for revenue may not accurately reflect customer loyalty or growth in times of inflationary changes.

A cost-to-serve analysis can help you accurately identify which rebate structures are disproportionately hurting your business.

Special Value-Add Offerings

This can include items such as special packaging, custom designs, or engineering plans—all value that you should be paid for. Often companies will waive or heavily discount items such as custom support for new customers, and then mismanage the removal or adjustment of that discount once a customer is established.

A cost-to-serve analysis reveals customers whose product or service needs are not properly captured in their price, signaling an opportunity to update your pricing model.

In addition to these two examples, there are several other discount-based price leaks that could be costing you:

- Co-op advertising

- Early payment discounts

- Free materials / samples

- Seasonal discounts

- Volume discounts

Common Policy- or Fee-Based Price Leaks:

Freight Costs

Freight is one of the most common leaks for manufacturers and distributors. Since it isn’t as tightly controlled as price, it’s an easy element for sales teams to manipulate to sweeten a deal. The problem is, if you’re absorbing your own pricey freight charges, your profitability is slowly eroding away.

A cost-to-serve analysis will look at freight policies by territory, size, lead time, and more to determine if that customer is costing you more than you realize and pinpoint areas of improvement.

Payment Terms

Because interest rates aren’t fixed, the payment terms you set up early on for a customer may no longer be relevant and could actually be hurting your bottom line. What makes sense when interest rates are low won’t have the same outcome as when they are high and vice versa.

Examining a customer’s cost to serve will shed light on which payment term policies and discounts are no longer profitable and need to be renegotiated.

Contract Terms

Contract terms are complex because they often contain a subset of different terms and policies for different customers. Whether it’s a formal or informal contract, the terms can get stale quickly and are easy to overlook over time. Additionally, we often find that customers have been given special terms to sign a new contract, only to renew those terms year after year without proper review.

Contract terms should be documented by customer, and then a cost to serve analysis can surface which price leaks need to be addressed through new terms or contract language.

In addition to these three examples, there are several other policy- and fee-based price leaks that could be costing you:

- Credit card fees

- Environmental fees

- Minimum order charge adherence

- Restocking fees

- Rush order charges

- Small order charges

- Storage / inventory fees

- Warranty adjustments

How to Calculate Your Cost to Serve

Different customers have different factors and behaviors that significantly impact their cost to serve. Delivery time, frequency and size of orders, program discounts, and payment terms are just a small example of how profits can quickly disappear if left unchecked.

Client Example:

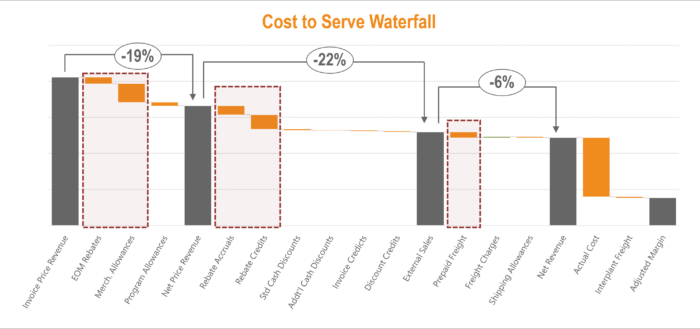

A multi-billion-dollar manufacturer of building products had recently raised prices due to raw material increases but was not seeing pull through of those increases to margin results and wasn’t able to isolate why.

INSIGHT began by utilizing our expert data engineering capabilities to consolidate over 250 data files, including transactional data, rebate files, and cost data, and built a bottom-up transactional cost to serve waterfall. Once the cost buckets were identified, INSIGHT was able to surface low-margin customers and products compared to their peers through price variation analysis. Then, INSIGHT partnered with the manufacturer to conduct targeted price adjustments on low- and negative-margin customers, as well as to redesign those programs and policies causing the most price leakage. This included:

- Year-end and quarterly rebate program

- Winter-buy program

- Customer contract discounts, including freight terms

As a result, the manufacturer’s pricing solution led to 8% bottom-line revenue growth.

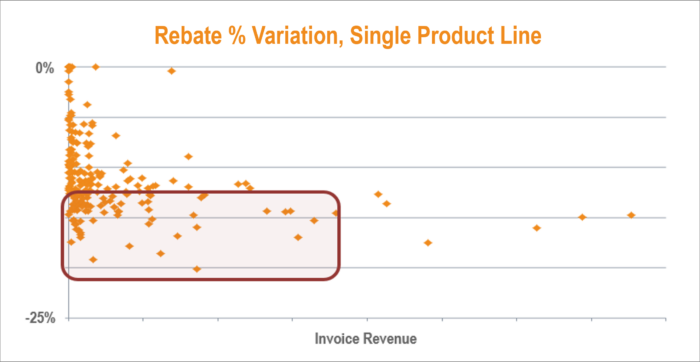

Many smaller customers had large rebate %s when it wasn’t warranted based on their purchase volume and revenue.

How to Utilize Cost to Serve to Manage Margin and Increase Profits

If you find margin or revenue decline is occurring in your business, there are a few corrective steps you can take to plug your losses and increase profits.

- Review the profitability of customers: Determine cost allocations by customer and product and generate a clear picture of which are driving profitability or margin decline. Create a plan to address negative or low-margin customers and products through targeted pricing actions, whether that’s protecting price, increasing price, or adjusting pricing policies.

- Review the overall profitability of existing programs and policies: Make sure you are regularly calculating if costs are outpacing revenue for all standard policies and programs in place. If you are in the red, the policy should be revisited for potential redesign and customer compliance.

- Pinpoint customers that are not compliant to pricing policies: Your cost to serve analysis will reveal customers that are operating outside of an existing policy. Sales should be made aware of these customers, and your pricing organization should create a plan that brings customers back into compliance, whether through customer communications or policy redesign.

- Redesign programs to accurately capture value being delivered while optimizing profitability: If the entire program is operating at a loss, regardless of customer compliance, it’s time for a redesign.

- Train sales and build guardrails to protect price leaks from occurring: Make sure your sales organization understands the details of all pricing programs, the expectations of them to uphold the policies in place, and the appropriate external messaging. Additionally, guardrails should be implemented to ensure ongoing compliance, such as approval processes, system flags, and consistent measurement of results.

Is It Time to Perform a Cost-to-Serve Analysis?

Understanding the cost to serve your customers is crucial to improving profitability because it allows you to identify opportunities for innovation, operational efficiencies, enhanced segmentation, and targeted pricing actions. Although the cost to serve analysis itself might not be simple, the decision to undergo that analysis is.

Thanks to the tenure and expertise of our team, we know the types of information needed from your business to quickly identify and quantify opportunities for profit improvement, and we’re not at all intimidated by messy, unstructured data. We turn this data into actionable knowledge by building robust pricing analyses that expose blind spots and inform data-driven pricing decisions that strengthen your pricing strategy. Then, we create tailored pricing solutions for your unique business challenges to maintain continuous profit improvement.

If you’re ready to find out the true value of your customers and cause of margin shifts, INSIGHT can help. Contact us to uncover the real impact cost to serve is having on your pocket price as well as identify steps you can take to right-size your profitability.