Unlock Margin Growth in 2024: Pricing Plays Your Business Can’t Afford to Overlook

Where should Private Equity Firms focus as they build their value-creation plans for 2024? Following several weeks of in-depth planning sessions and insightful conversations with leading CEOs and CFOs, we’ve surfaced key market insights and trends to guide organizations toward maximum margin growth.

Too many organizations underestimate the significance of pricing in value creation. Restricting pricing strategies to reactive responses during inflationary periods is shortsighted and detrimental to businesses. Pricing has consistently proven its worth as a fundamental driver for growth throughout the history of economic cycles, and it should be treated as such. Successful organizations invest in continuous refinement of pricing strategies, recognizing their potent impact on profit margins with an endless lineup of methods and channels to leverage. Regardless of economic conditions, pricing remains a strategic profit lever that demands continuous monitoring, adjustment, and advancement. This pragmatic approach ensures sustained growth across your portfolio.

In 2024, we anticipate inflation and interest rates will continue to dominate headlines, with some sources suggesting a potential dip into a recession. Despite these cautions, there remains plenty of evidence and optimism toward investment and growth opportunities across an abundance of industries. We know from years of experience through various economic conditions that pricing plays an immense role in how successful a business will be at capturing desired value. This underscores the importance of integrating pricing strategies into all value-creation plans, even if they diverge from conventional approaches.

The Value of 1%

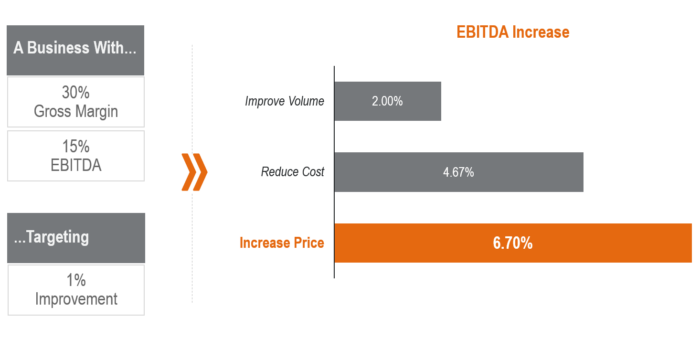

Warren Buffet’s quote, “The single most important decision in evaluating a business is pricing power,” remains as relevant today as ever. While businesses understandably focus on cost and volume, a common mistake is to underestimate or disregard the pivotal role that pricing plays in the margin equation.

The power of price is greater than cost and volume and should be treated as such.

Certainly, cost and volume are significant factors, but overlooking the pricing aspect fails to address the fundamental issue and often results in missed profits – something Private Equity Firms must avoid at all costs to satisfy their value creation plans.

The key challenge for most Private Equity Firms lies in understanding the specific areas of pricing that a portfolio company should focus on for greatest success. Pricing is a robust discipline with a wide array of strategies and approaches that can and should be customized to suit individual businesses. However, there are overarching themes that can be applied across your portfolio to optimize outcomes. In some cases, these strategies are essential to establishing a robust foundation and ensuring sustainable success. To assist Private Equity Firms in crafting and prioritizing their 2024 value creation plans, we have identified five pivotal areas within pricing that we believe will provide the greatest impact and margin growth opportunity for companies in the coming year.

1) Data Drives Multiples – Foundational Data Practices are the Core of Success

Garbage in, garbage out. Quality data is the foundation for intelligent decision-making, but many organizations fail to fully grasp what’s occurring in their business – and respond to it – because they don’t have access to quality data.

Quality data provides:

- The truth behind business results

- A roadmap to successful margin growth

- Confidence in your value creation plan

- Ability to pivot swiftly and make informed, agile decisions

Common problems we see with data:

- Massive amounts of data scattered across various locations

- Data that isn’t organized or structured in such a way to extract information from it

- Different sets of data that seem to say different things or contradict each other

- Gaps in critical details

- Difficulty finding the facts amidst the noise of irrelevant information and clutter

- Incredibly time-consuming to wrangle data to a usable state

- No easy way to translate data at a regular occurrence for an ongoing cycle of feedback

- The technology behind data management is cumbersome and/or not easily implemented across an organization

- Internal resource constraints

- Changing data attributes

- Uncertainty around calculations for price, margin, revenue, or other measurements

There are many more. These data challenges lead to misdiagnoses of business situations, prompting inappropriate responses to volume, revenue, or margins. Consequently, valuable time is wasted. The reality is data has the potential to offer much more. However, most organizations invest so much time trying to understand data, that they’ve missed the opportune moment to respond effectively to its insights.

Data drives multiples, but only when it is utilized successfully. It enables you to quickly surface essential insights for better decision-making, get ahead of business challenges, and proactively generate margin growth plans you can be confident in.

Pricing cannot be optimized without quality data. If there’s one thing Private Equity Firms can do in 2024 to boost margin, it’s invest in quality data solutions.

2) Stabilize Results by Building a Pricing Strategy Based on Value, not Cost

If the last few years taught us anything from a pricing perspective, it’s the importance of understanding and delivering on your organization’s value. Inflation, disinflation, supplier demands, consumer expectations, raw materials and labor costs, market headlines, and more put a wrench in many businesses’ pricing strategies, revealing the downfalls of relying purely on cost-plus pricing strategies.

Today, many companies are facing a common threat – customers who want price back. In whatever fashion that surfaces – volume loss, customer churn, competitive threats – these headwinds are just one example of why pricing based on value is so important. In cases where businesses raised price to directly combat rising costs, and communicated it as such to the market, customers are now pushing back, and we can understand why. The missing piece is value – communicating value, pricing on value, and segmenting customers and products as such. One can argue your costs are still rising, or price changes never quite caught up to your increased costs, but customer sentiment and rhetoric is difficult to contest with strong competing market headlines. Pricing based on value turns a customer transaction into a customer relationship.

This type of pricing provides substantial benefit for your portfolio companies because it not only drives revenue optimization, but also helps you understand your market and customer profile to enable smarter decision-making. Certain groups of customers may value quality or service above all else, while others may be incredibly price sensitive. Cross-reference these customer attributes with product attributes and market trends – such as regional competitive dynamics – and you have better messaging for customers to meet them where they are and grow long-term relationships. If you have questions around your market landscape and customer perceptions, a market intelligence study can help answer unknowns that drive better pricing decisions.

However, simply pricing based on value isn’t enough. Companies must ensure they are consistently delivering on that value. Many of our clients maintain pricing health scorecards to ensure key areas such as quality and delivery levels achieve customer expectations so they can justify the price, and pivot messaging as goals change.

3) Compound Results by Going Beyond Annual Price Increases

A prevalent risk many organizations face is price fatigue, or the fear of it. Many of our clients believe the market won’t accept more price and are left unsure how to handle their rising costs or declining margins.

Private Equity Firms can benefit greatly from enabling their portfolios to invest in pricing actions that go beyond annual price increases. While these play an important role, price adjustments are only the tip of the spear in terms of pricing excellence.

The first step is to recognize that each company is unique and requires a more surgical, intentional approach to pricing to maximize the output. Then, be vigilant in identifying and closing the gaps to support your margin goals. Remember that sometimes holding price can be beneficial, especially when costs drop. But now is the time to go beyond the traditional price adjustment practices and invest in a best-in-class pricing strategy that drives long-term growth throughout economic cycles.

There are several pricing activities a business can invest in that will reap incremental margin benefit, including:

- Price leak management (rebates, freight, payment terms, etc.)

- Discount management

- Micro-segmentation

- Sales force effectiveness (price realization, negotiations, compensation, etc.)

- Cross- and upsell opportunities

- Mix optimization

- Promotional effectiveness

- Churn management

- Wallet share

- SKU rationalization

- Capacity utilization

- New product pricing

- Inventory management

These pricing-related practices pave a path toward margin growth when price increases aren’t palpable, while also bolstering best-in-class pricing success for years ahead.

It’s not always easy to spot these opportunities, often they are hidden in the data. INSIGHT offers a quick 2-week diagnostic – both when evaluating businesses and across a hold cycle – that reveals and quantifies pricing opportunities you can be confident in executing.

4) Leverage AI and ML to Boost Valuable Intelligence

It’s no secret that AI and ML are the future. Firms are searching for ways to implement smarter AI and ML solutions across their portfolios, and pricing should be included in that initiative.

From an investment standpoint, the benefits of AI put Private Equity Firms ahead of the pack. A recent article, AI use cases and applications in private equity & principal investment, states, “As the world’s data volume is expected to reach 163 zettabytes by 2025, with 80% being unstructured, investors harnessing even a fraction of this data will gain deep, actionable insights for highly informed investment decisions.”

In value creation, AI can be deployed across your pricing strategy to realize the opportunities identified during due diligence. Machine learning models can be used for purposes such as:

- Generating optimized price points

- Understanding customers & their behavior

- Identifying areas of projected price sensitivity

- Revealing and predicting customer trends – e.g., churn, volume

- Surfacing market trends – e.g., competitive changes

- Market basket analysis – e.g., cross- & upsell opportunities

- Estimating cost

- Route optimization

- Promotional effectiveness

- Demand forecasting

INSIGHT has over a decade of experience applying AI and ML methods across diverse industries and client use cases. From aggregating data and matching data sets to building smart dynamic models, we help Private Equity Firms decide which investments have the greatest and most reliable pricing opportunities, and then implement pricing strategies that optimize results over time leveraging all of the avenues listed above – and more.

5) Don’t Just Build a Plan – Drive Sustainable, Long-Term Growth

The worst outcome of a pricing initiative is profit growth that results in a higher valuation midstream but isn’t sustained. It’s imperative for Private Equity Firms to invest in value-creation opportunities that are a reliable source of growth, even more so if that growth continues – and stacks – incrementally over time. That is exactly what a successful pricing strategy can deliver, but only if initiatives are accomplished with structure and sustainability at the core.

While conceptually this is a no-brainer, implementation can be difficult, especially across a set of portfolio companies with varying operational and pricing sophistication and resources. Three areas that can help drive considerable impact are 1) Change Management, 2) A Pricing Center of Excellence, and 3) Data Analytics.

Change Management

Regardless of what pricing strategy you’ve set, it is all for naught if it isn’t implemented successfully. Change management encompasses a swath of functions, including but not limited to:

- Establishing and training the commercial organization on your value and key messaging

- Communication strategies to the market

- Coaching workshops to build skills and confidence across the commercial team – e.g., negotiation training

- Establishing pricing governance structures, including approval workflows and guardrails

Successful change management looks like:

- Desired price realization

- Adoption of and accountability for expected behavior

- Margin growth

Pricing Center of Excellence

The Pricing Center of Excellence governs pricing decisions and picks up where change management leaves off. It encompasses 3 main functions:

- People – Establish a pricing organization design that functions optimally for your company, then work to retain top talent

- Process – Institute pricing processes that support ongoing salesforce effectiveness, drive accountability, and facilitate continuous improvement

- Tools – Deploy software and analytics that enable smart, nimble decision-making

Data Analytics

We would be remiss not to highlight data again, as it is the foundation for all pricing success. Price measurement through data analytics drives short- and long-term results by monitoring the effectiveness of pricing initiatives, surfacing deviations from desired outcomes, and unveiling deep insights that facilitate confident decision-making.

For Private Equity Firms, measuring impact across a portfolio can get complex. INSIGHT offers a unique solution that allows Firms to centrally track and manage the impact of pricing and other profitability initiatives across portfolio companies throughout the hold cycle. Profit Analytics is an innovative approach to data analytics, offering a centralized, comprehensive view of your entire portfolio through a spectrum of analyses that direct your attention toward the most critical margin opportunities and risks.

Learn more about Profit Analytics

Given pricing’s evident impact on value creation plans, Private Equity Firms would best position themselves for growth by investing in long-term sustainability.

Unlock Margin Growth with INSIGHT2PROFIT

Strategic pricing, and all its related practices, can drive some of the greatest and most sustainable margin growth across your portfolio. However, most businesses miss out on its benefit because they aren’t attuned to all of pricing’s capabilities and the power behind effective execution strategies. Whether you are new to pricing or have an established pricing function in your Firm, INSIGHT can help elevate your portfolio’s pricing strategy to multiply results. Our years of experience across industries and economic cycles uniquely position us to provide best-in-class pricing strategies and data solutions that you haven’t thought of. But we are a partner – that means we adopt your goals and are relentless in executing until results are delivered. Contact us to learn more about how INSIGHT can help deliver on your value creation plan.